NRCA sends letter to Congress in support of Energy Efficient Commercial Building Deduction

On June 23, NRCA joined with 75 allies in a letter to express strong support of Section 179D, the Energy Efficient Commercial Building Deduction. The letter urges preservation of Section 179D and opposes the proposed wind-down of the deduction included in the Senate Finance Committee’s reconciliation bill text.

The letter explains that “Section 179D was first enacted under President George W. Bush in the Energy Policy Act of 2005 and made permanent under President Donald Trump in 2020. Section 179D is an enhanced tax deduction akin to accelerated cost recovery that enables commercial building owners to offset investments in proven, yet innovative, energy efficiency technology. Section 179D encourages private investment in infrastructure upgrades to lighting, HVAC and building envelope, powering job creation in the trades, construction, engineering, and manufacturing that contribute to America’s economic strength and competitiveness.”

Roofing industry calls for increased funding for Perkins CTE State Grants

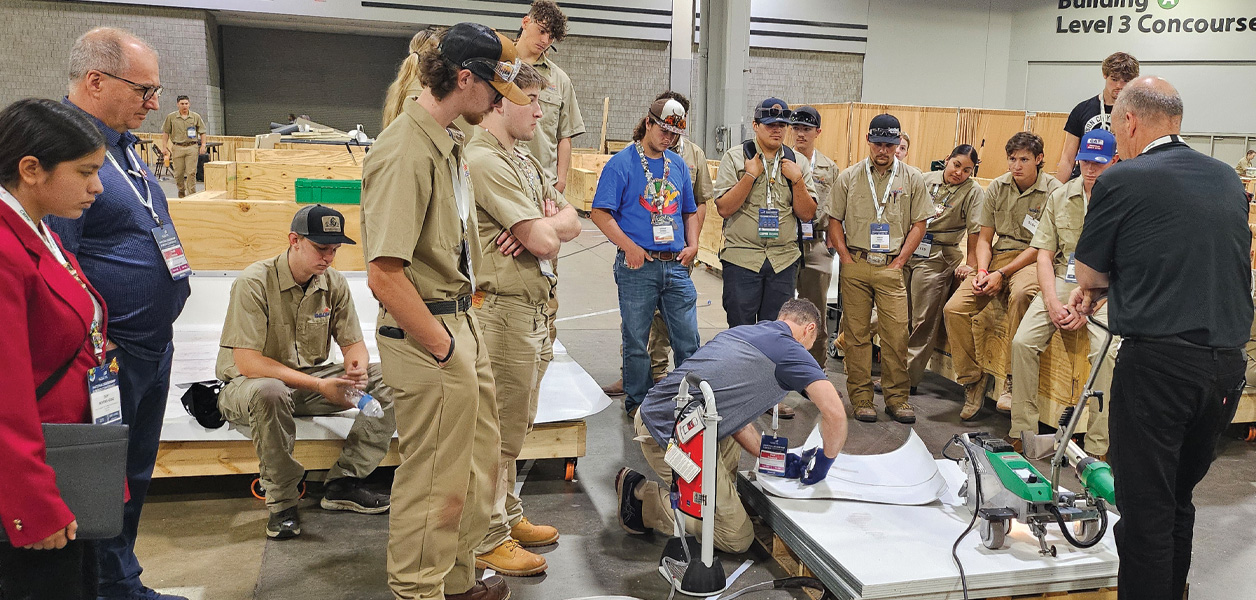

On June 23, NRCA and fellow roofing industry allies sent a letter to Congress requesting a robust increase of $70 million or more exceeding the fiscal year 2025 level for Perkins CTE State Grants. This funding is critical to providing students with the resources and opportunities they need to excel in their studies and help ensure the U.S. has the skilled workforce needed for the future.

Chronic workforce shortages are the top challenge facing roofing industry employers across the U.S. as demographic trends make it increasingly difficult to find qualified candidates for well-paying, family-sustaining jobs. Increased funding for career and technical education is essential to providing strategies and tools to help employers address future workforce development needs. Please take a moment to contact your members of Congress using NRCA’s grassroots website and ask them to support funding for this vital program.

House Committee approves amendment to expand H-2B program

The House Appropriations Committee approved a fiscal year 2026 Department of Homeland Security appropriations bill and adopted an amendment to expand and improve the H-2B seasonal visa program for 2026. The amendment creates a new “certified seasonal employer” designation for program participants that exempts any employer that received an H-2B labor certification during the past five fiscal years from the annual statutory cap of 66,000 visas. This will allow for significant expansion of the number of H-2B visas, providing more opportunities for employers, including many NRCA members, to address workforce needs during peak season in 2026. NRCA is pleased to see the amendment, spearheaded by Reps. Andy Harris (R-Md.) and Chellie Pingree (D-Maine), approved with bipartisan support and will continue working to maximize the effectiveness of the H-2B program as Congress further considers this legislation.

DHS issues guidance for E-Verify procedures

On June 20, the Department of Homeland Security issued updated guidance for employers who use the E-Verify program to check the employment authorization status of employees given recent changes in federal immigration laws. The guidance indicates the E-Verify system will no longer notify employers via case alerts that certain employees have had their Employment Authorization Document revoked. Going forward, employers should regularly generate status change reports to identify E-Verify cases created with an Employment Authorization Document that has been revoked. More information is available on the E-Verify website, and employers may wish to consult legal counsel regarding employees who lose employment authorization and must be terminated if they cannot obtain alternative legal status.

Support ROOFPAC over drinks at NRCA’s Midyear Committee Meetings in Chicago

Join your roofing friends and colleagues for a lively cocktail reception benefiting ROOFPAC on Wednesday, July 16, from 5:30 to 7 p.m. at Siena Tavern in Chicago. Enjoy catching up with fellow industry professionals over tasty cocktails and Italian treats—all while strengthening the voice of the roofing industry on Capitol Hill ($175 per person/$275 per couple). Members of NRCA’s Political Insiders Council and Capitol Hill Club, along with their guests, receive complimentary admission. Special thanks to our sponsor Johns Manville for making this event possible.

For more information or to register, please visit www.nrca.net/roofpac-midyear-event. For any questions or to secure the couples’ rate, contact Teri Dorn at (202) 510-0920 or tdorn@nrca.net.