-

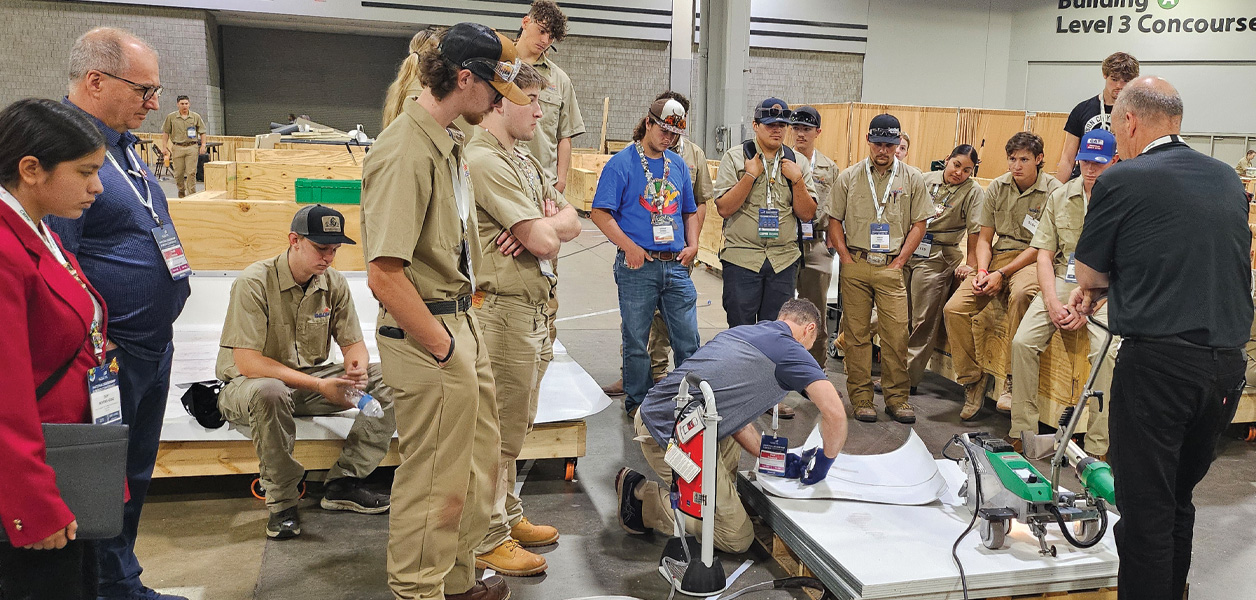

Benefits of working with your local trade school

-

OSHA letter explores whether burns from personal lithium batteries are work-related

-

Contractors were more optimistic in January

-

NRCA will offer CERTA class

-

This Week in D.C.

-

QXO will acquire Kodiak Building Partners for $2.25 billion

-

Stopping the spread of germs during the season of sickness

-

NRCA welcomes new members

-

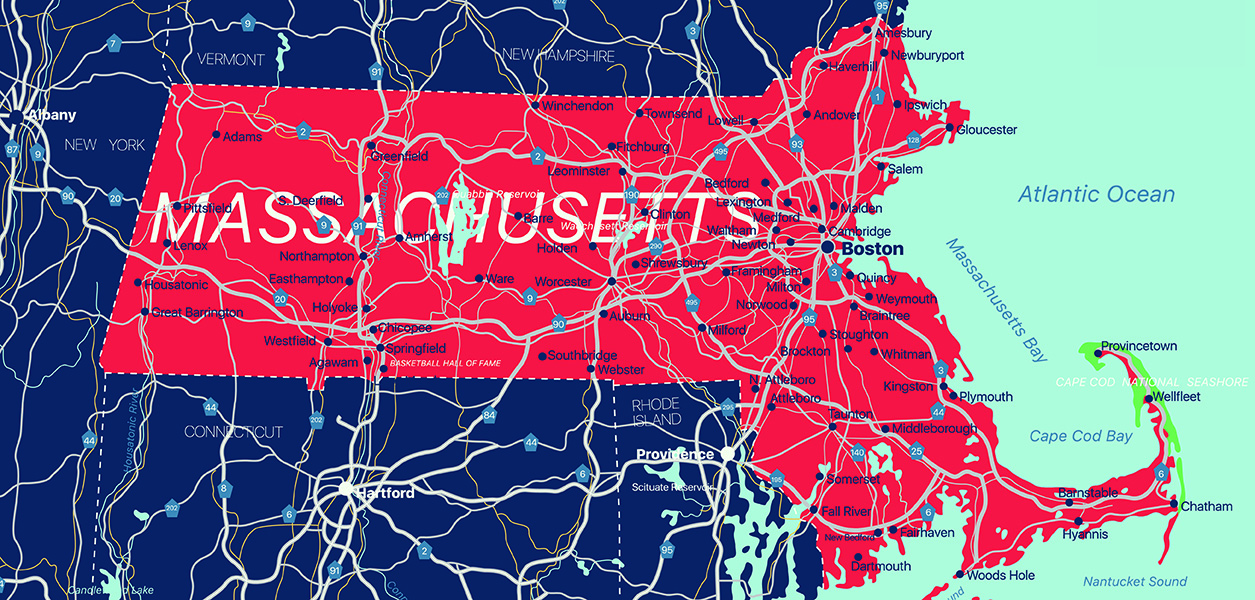

Responding When a Lawful Worker Is Detained or Removed

-

Construction job openings increased in December 2025

-

IRS shares things to remember when filing 2025 income tax returns

-

What do you do when you cannot promote a high-performing employee?

-

Man sets house on fire when trying to melt ice on his roof

-

Professional Roofing’s February issue is available

-

This Week in D.C.